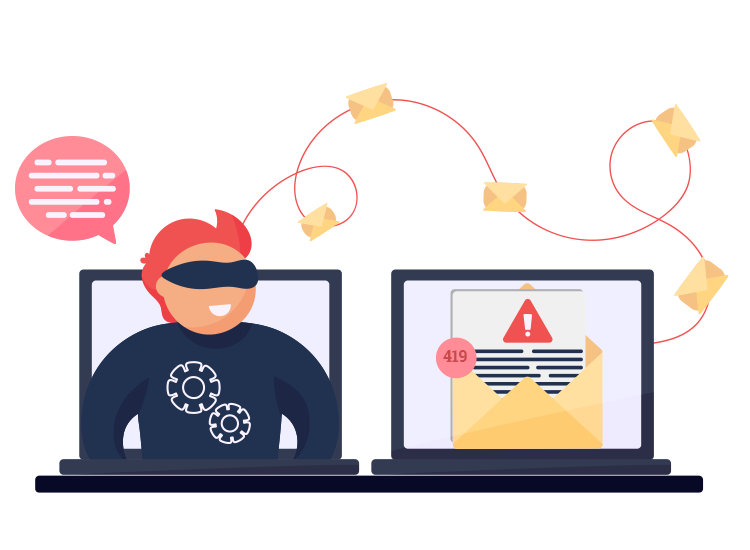

The Nigerian letter scam is one of the longest-running online scams. Also known as the advance fee scam, this has a long online history. Another name for it is 419 fraud, which comes from a section of the Nigerian Criminal Code that forbids this activity.

Read on to learn how this scam works and how to protect yourself against it!

How Does Nigerian Letter Scam Work?

The scam is really serious, as it has fooled many people. This happens as the idea of making easy money might seem appealing. Also, because hackers use emotional messages.

So, criminals send emails, or messages on social media platforms. Usually, they pretend to be businessmen, members of a very rich family, or even government employees.

But you might find a variety of these messages. Thus, sometimes fraudsters may send congratulations for winning a lottery, or ask for help with different activities. Or they might claim to offer employment opportunities in exchange for victims’ help.

These emotional messages have one thing in common: asking victims to help retrieve important sums of money, from an overseas bank.

To make some fast and easy money, they try to convince potential victims into unveiling their personal information. This includes social security numbers, passwords, and bank account information.

Thus, they try to obtain access to the target’s bank accounts and also dupe their victims to pay different taxes.

How to protect yourself from this scam?

To stay away from scams, there is a golden rule: never reply to any suspicious emails, especially if they come from unknown senders.

To keep away from The Nigerian letter scam, you should:

- Never give strangers access to any of your accounts or sensitive documents.

- Never sign agreements if strangers request upfront payments through money orders. You would never be able to recover your money.

- Never transfer money on another person’s behalf.

You should also be aware of other internet scams. We explained them here. Now, that you know how to stay away from scams, you should never worry about your account’s safety.